Our development cooperation projects

With a portfolio of over 380 development cooperation projects across nearly 150 countries, we engage in key areas of sustainable development and contribute, with the help of our partners, to the Sustainable Development Goals (SDGs). Here are some of our development aid projects spanning governance, security, climate, health, digital technologies, education, and more.

Featured project

“Pour Elles”: Sport and Culture

This project uses sport and culture as tools for reducing gender inequalities for the benefit of Congolese young people, especially women.

- When ?

-

2024 - 2028

Status

Ongoing

- Location

- Democratic Republic of the Congo

- Funders

- Agence française de développement

- Financing amount

- 10m €

Explore our projects

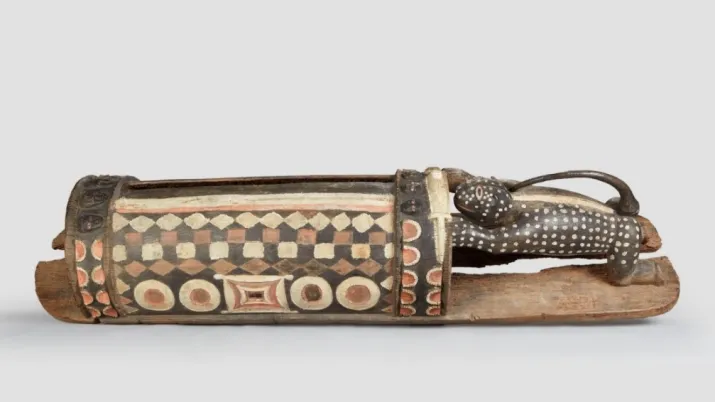

Museum cooperation in Côte d’Ivoire

Ongoing

2023 - 2025

Funders : Ministry for Europe and Foreign Affairs of France

mAIDan Ukraine - Technical assistance facility for Ukraine

Ongoing

2023 - 2026

Funders : Ministry for Europe and Foreign Affairs of France

Our focus areas

Expertise France is currently implementing 384 projects designed around six major focus areas.

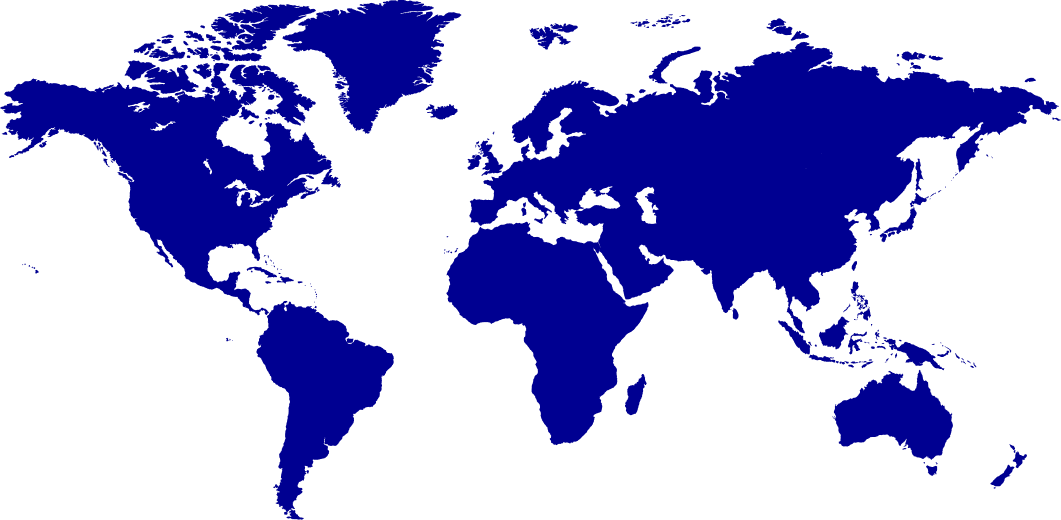

Our projects around the globe

Key figures

- 384 projects underway

- 800 million euros in new projects agreed in 2024

- 147 countries of operation